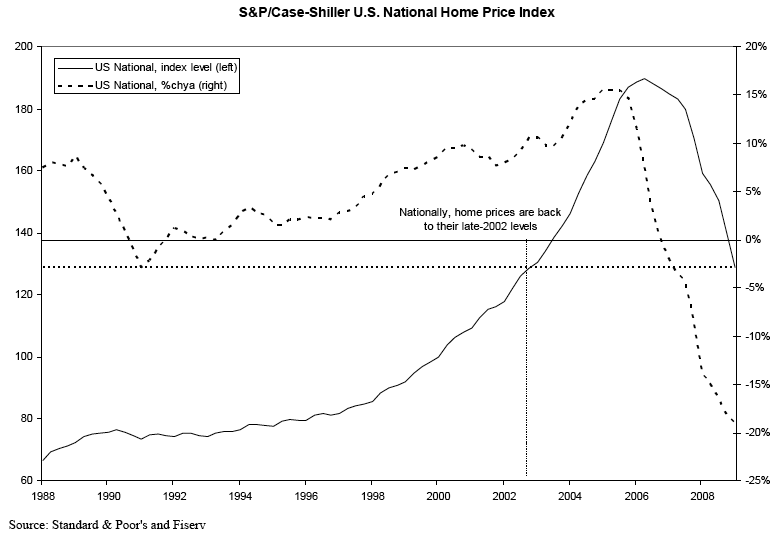

As of March 2009, average home prices across the United States are at similar levels to what they were in the fourth quarter of 2002. From the peak in the second quarter of 2006, average home prices are down 32.2%.

The S&P Case-Shiller National Home Price Index fell 19.1% in Q1, the sharpest drop in history. Charlotte, NC did best, rising 0.3% while Detroit, where prices have fallen to 1995 levels, did the worst at -4.9%. San Francisco came in at -2.2%.

The 20 city index peaked in July, 2006 at an index value of 206.5 and the March reading stood at 140.00, making for a 32% drop from the peak.

Given the pace of decline, I do not think it is out of the question for for a peak to trough drop in the 45% range.

Housing prices must be at 3 times to 4 times annual household income and maybe even lower if we have a generation of stay at home mothers….to me..prices are getting back to where they belong and square footage on new construction will fall from palatial levels of the past decade…Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â San Diego housing

Property prices are only beginning to tumble. They will stabilize when they finally hit or surpass equilibrium value as determined by their P/E Ratio.

San Diego real estate agents

Although the foreclosures may have plateau, the correction still has a little ways to go. Sorry, fundamental values stand for SOMETHING and are really your best bet against big losses.

San Diego California real estate listings

Tough times in real estate may change the San Diego conventional wisdom that you can never lose in real estate.

San Diego bail bonds