Real estate home sales – – I believe Nancy Pelosi said something like if you want to know what’s in the healthcare bill (Obamacare) you have to pass it. Well, unfortunately as we all know, with a lot of backroom deals, Obama care is now law, and we’re slowly finding out really what’s in it.

Real estate home sales – – I believe Nancy Pelosi said something like if you want to know what’s in the healthcare bill (Obamacare) you have to pass it. Well, unfortunately as we all know, with a lot of backroom deals, Obama care is now law, and we’re slowly finding out really what’s in it.

I know I’m going to get a lot of flak on this, but the flak will be mainly over my use of the term “tax.” It seems politicians are great on trying to trivialize facts; they get into the minutia of the debating the meaning of common words. So, tax may sound better as a fee, a levy or even a deduction. For the sake of this post, I’ll go with calling this what I think it is, a tax. Buried deep inside Obama care is a provision that starting in 2013 (it’s not a coincidence that this starts right after the presidential elections) if you sell your home, or for that matter any real estate you may be subject to the new Obama care 3.8% sales tax.

Here in San Diego, home sellers, starting in 2013, in addition to all your other costs, you could end up paying $19,000 on a $500,000 profit. This new passive income tax would also apply to interest earned dividends and other sources of income categorized as passive income.

So who is this that tax going to affect the most? The retiring generation. After saving all their lives, moving up from a starter home to a midsize home, to a large home, and now getting ready to downsize, these evil seniors should really pay for working hard, having a disciplined savings plan, all while taking advantage of the downtrodden. So, now’s the time to even the playing field a little. Obama, Nancy and Harry are really going to put it to these capitalist senior homeowners!

A couple of points to keep in mind about this new tax;

#1. It’s not indexed – – this means that even though starting out, it applies to individuals making a modified adjusted gross income (AGI) of greater than $200,000 and taxpayers filing jointly in excess of $250,000. it may just apply to a small number of taxpayers, but, because it’s not indexed, because of inflation, in just a couple of decades, this new tax could well apply to the majority of middle-class earners.

#2. Many say it just applies to the high income earners. The fact is, because of the sale of one’s home, depending on your profit, this tax can apply to you. Because even though you may be below the threshold limits the sale of your primary residence could make you a high income earner in the year of the sale.

Lastly, I’m sure many will say the average home sale and therefore average real estate game is much less than the threshold limit of this Obama care tax. I must admit, that if you consider national averages such a statement would be correct. But here in San Diego, and for that matter most of California, and many other high home price locations where homes typically sell for 2 to 4 times the national average, this new tax will be a factor that could affect a large portion of senior citizen homeowners.

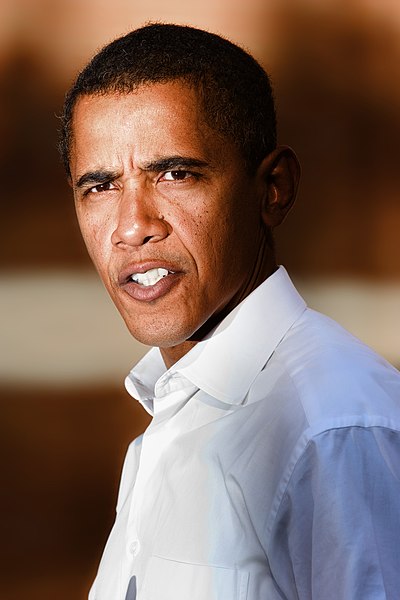

President Barack Obama is no friend of homeowners. In my 6-29-09 post: Real Estate Tax Deduction – Soon To Be History? , I pointed out that the than Obama proposed budget called for a cap on the mortgage tax deduction for couples earning $208,850 or more. Yes, that idea was dropped in light of heavy opposition. But, what do you think will be proposed by Obama if re-elected? Who knows, but I feel it will not be good for the real estate industry.

Here is a link to the current IRS rules on home sales: http://www.irs.gov/publications/p523/ar02.html#en_US_publink1000200623

Ok, here is the disclaimer: This is a very complicated topic and I am not a licensed tax consultant or a tax authority, and that the purpose of the article is illustrative and not to be taken literally.

The new Medicare tax would apply only to any gain realized that is more than the $250K/$500K existing primary home exclusion (known as the “taxable gainâ€), and only if the seller has AGI above the $200K/$250K AGI thresholds.

The real story about this new tax is that the 3.8% Medicare tax is assessed only when Adjusted Gross Income (AGI) is more than $200,000/$250,000. AGI includes net income from interest, dividends, rents and capital gains, as well as earned compensation and several additional forms of income presented on a Form 1040 Income Tax Return.

1) The extra tax will actually apply to anyone, even someone making $20,000 a year, as long as their profit on the sale of their home is greater than $250,000 (single person) or $500,000 (married couple). In other words, the deciding factor on if you need to pay this extra tax is the amount of profit on the sale of your home, NOT your income. 2) You will pay capital gains taxes on the amount of profit over $250,000 (if you are a single person) and $500,000 (married couple) AND THEN the additional 3.8% tax hidden on the Obamacare Bill. 3) You might have to pay a tax of 3.8% of the amount of the gain over $250,000, for a single person.

Obamas moto is “work hard all your life, do well for yourself, and we will get you in the end”.

It doesn’t matter if this tax effects you or not. It will affect alot of people. Just because you dodged the bullet this time dosen’t mean you won’t be the next target.

I agree that this tax should not have been in a Healthcare bill, that no one read before the vote. Makes you wonder what other surprises are in store.

The real fun starts when people start getting fined for not purchasing health care in 2014.

Is the glass half full or half empty? Sure this tax will not affect everyone selling a home, but it will obviously effect so many people that the tax had to be HIDDEN in Obamacare.

What the hell is a tax such as this doing HIDDEN in a healthcare bill? Why are there so many sneaky things HIDDEN in Obamacare that a nations healthcare has to be administered and policed by the IRS?