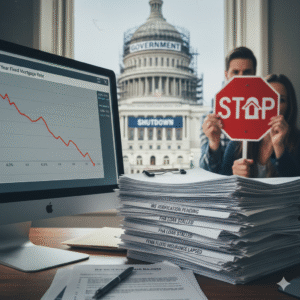

Jim Rogers (In 1970, Rogers joined Arnhold & S. Bleichroeder, where he met George Soros. That same year, Rogers and Soros founded the Quantum Fund. During the following 10 years the portfolio gained 4200% while the S&P advanced about 47%. It was one of the first truly international funds) in a recent TV interview said about the recent government actions and bail-outs: “

“It’s a mistake what they are doing. It’s giving short-term pleasure, but there’s long-term pain as we are going to have much higher inflation, much higher interest rates and a worse economy down the road. Throughout history, the center of the world has shifted to where the capital is, where the assets are. You don’t see any period in history where things are shifting to the debtors, and America’s the largest debtor nation in the history of the world. Unless something’s different this time, unless the world’s changed very very dramatically, the center of the influence, the center of the power, the center of the earth, the center of the globe, is going to be shifting towards Asia, because that’s where all the money is. Have you ever heard of anybody saying, ‘Let’s go to where all of the debtors are’? It just doesn’t happen that way.”

Obviously, Rogers thinks the United States and the U.K. are in bad shape and will be for some time. He likens the current situation to that of the 1930s. He says:

“In the 1930s, we had a huge stock market bubble which popped. And then politicians started making many mistakes. They became protectionist. They made solvent banks take over insolvent banks and then both banks failed in the end. They are making many of the same mistakes now. What’s different this time is that we are printing huge amounts of money which they did not print at that time. So, we are going to have inflation this time.”

Why do we think jeopardizing our country’s future for short term gain is a good idea? As a whole, Americans live beyond their means and rely on….credit. You can’t expect Uncle Sam to “fix” all of your personal finance problems. Time to let the chips fall where they may…

San Diego County real estate agents

As the Chairman of The Federal Reserve speaks about “Juicing the Economy” are we as Americans looking to what the long term will bring. If we keep making the dollar so easy to borrow as a short term stimulus to our economy are we not devaluating the current abroad making foreign products cost more to import?

San Francisco lawyers

If we can bail out the rich (socialism) Then let’s do the stupid as well (socialism),

or we could practice real capitolism and let them crash and burn.

It would get rid of the crooks and make oppertunity for the knew blood to have a go at it.

To think that Betting your life savings in the stock market was a good Idea?

Only fools would take a risk like that. (risk is ,the chance to loose it all)

Betting is for those that can afford to loose the money they bet. So Be It.

Who wants to talk about the the real issue of national debt and the day

we really will go belly up. Can’t anybody else see the future of this financial

disaster and stand up and tell the people the truth. We are Bankrupt.

We have to much on the credit card and the forecloser notice is already hear.

As a country we have taught the stupid to do the same in their own homes,

so The truth is people really only know what they have been taught. Ignorance

San Diego lasik surgery