The vote Friday by which the House approved a $700 billion government bailout bill: Voting yes were 172 Democrats and 91 Republicans. Voting no were 63 Democrats and 108 Republicans.

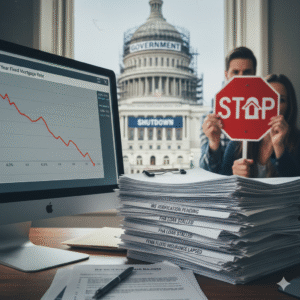

The following statement was presented on the floor of The House of Representatives after Congressman Kucinich voted against the Wall Street bail out plan, H.R. 1424, the Emergency Economic Stabilization Act of 2008: The public is being led to believe that Congress has reconsidered its position because we have before us a better bill than we had a few days ago. I

t is the same bill plus hundreds of new pages for hundreds of millions of tax breaks. What does this have to do with the troubles of Wall Street? Driven by fear we are moving quickly to pass a bill, which may produce a temporary uptick for the market, but nothing for millions of homeowners whose misfortunes are at the center of our economic woes. People do not have money to pay their mortgages. After this passes, they will still not have money to pay their mortgages. People will still lose their homes while Wall Street is bailed out. San Diego Realtors

And to top it all off—soon to be ex-President George W Bush will be leaving U.S. with a $10trillion dollar debt to be paid with declining home prices. Give me back Clinton’s 90s balanced budget economy any time compared to the nuts currently running Washington.

Eye Doctor

Home prices will fall up to 50%, the Fed can’t keep up with the jingle mail folks, cutting rates to 0 = 33% inflation. Poor, poor timing. Jimmy Rogers recently called on Blind Ben to resign, a total screw up.

SD Cosmetic Sugery

If you don’t vote, you may just be Standing in the soup line, instead of proposing just to see people in them. They already exist. Many will need to focus on making a go of it living below their means for a while; these Liars, Killers and Economy Destroyers need to answer to the People. This is a Democracy.

San Diego Clinicals

If we look at the economic trends along with Real Estate market trends, we can realize that what may seem like a “bad market” for some people is the same market that “big” Real Estate Investors have bought the properties that made them millions. However, there are many people that are getting ready to capitalize on some great investing due to the common sense theory of investing, BUY LOW…SELL HIGH!

Eye Care Specialist

Much is said now about the state of the real estate market, the recent audacity by the fed chair, and how our dollar is being trampled on by the feds. Much is said about the lack of equity in homes and the lack of liquidity from the few available buyers out there. The economy is dead; all these foreclosures are ruining the state.

Sacramento Lawyer